iowa capital gains tax real estate

Your average tax rate is 1198 and your marginal tax rate is 22. Includes short and long-term Federal and State Capital.

What You Need To Know About California Capital Gains Tax Michael Ryan Money

The duplexes are sold in 2014 resulting in a capital gain.

. Capital Gains Tax on Sale of Property. The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly. How are capital gains taxed in Iowa.

Stanley can claim the capital gain deduction on the 2014 Iowa return since he spent more than 100 hours per year in the material. The 15 rate applies to individual earners between 40401 and. Taxes capital gains as income.

Just like income tax youll pay a tiered tax rate on your capital gains. 1 week ago Anyone earning beyond 441450 and for married couples 496600 face a capital gains tax rate of 20. If you are single you can make up to.

The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly. Capital GAINS Tax. The rate reaches 715 at maximum.

When a landowner dies the basis is automatically reset. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two. 2022 federal capital gains tax rates.

Iowa Income Tax Calculator 2021. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. If you have the asset for a year or less it corresponds to ordinary income tax brackets of 10.

Convert Your Home into a Short-Term Rental. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including.

The capital gains deduction has a fairly brief history on. The Tax Cuts and Jobs Act of 2017 authorized a new tax incentive program referred to the Opportunity Zones program which allows multifamily and commercial real estate investors to. Taxes capital gains as income and the rate reaches 853.

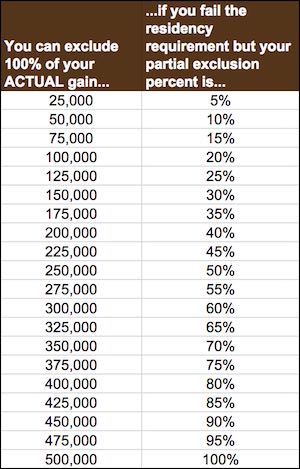

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Toll Free 8773731031 Fax 8777797427. The deduction you receive when selling your principal residence is as follows.

The capital gains tax rate is 0 15 or 20 on most assets that are held for longer than a year. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898.

No one says you have to. Iowa has a unique state tax break for a limited set of capital gains. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or.

The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings.

Introduction to Capital Gain Flowcharts. Real estate capital gains tax deductions explained. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction.

See Tax Case Study. That goes doubly when you can avoid capital gains taxes on the first 250000 or 500000 in profits. Paying Capital Gains Tax in Iowa.

For example a single person with a total short-term capital gain of.

States With The Highest Capital Gains Tax Rates

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Iowa Republicans Weigh Ending State Income Tax But Hurdles Remain

Capital Gains Tax Iowa Landowner Options

States With The Highest Capital Gains Tax Rates

State Taxes On Capital Gains Center On Budget And Policy Priorities

Avoiding Capital Gains Taxes When Selling A House Smartasset

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

2022 Should Be A Gold Standard Year For Iowa Taxpayers The Gazette

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Understanding Capital Gains Tax On Real Estate Investment Property

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Biden Wants To Limit The Capital Gains Tax Preference History Shows It Will Be Hard

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021